- Fri. Apr 26th, 2024

Latest Post

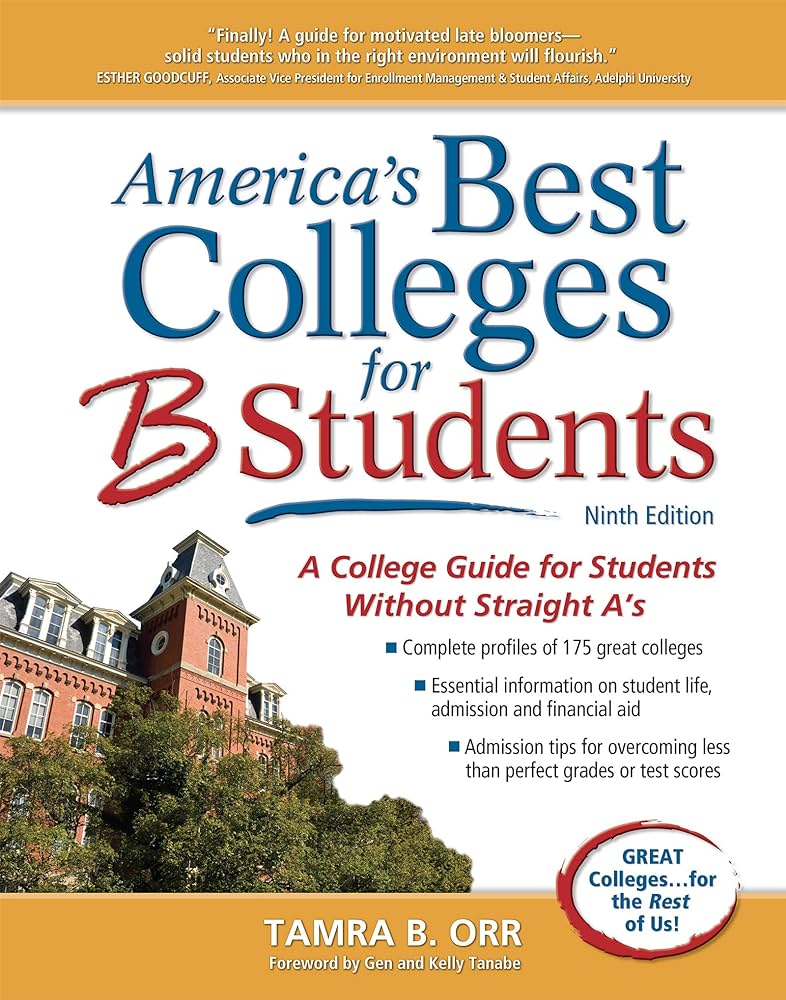

Comprehensive Guide to Colleges in the USA

The United States boasts a rich tapestry of higher education institutions, each offering unique opportunities and experiences for students. As prospective college-goers embark on their academic journey, understanding the diverse…

‘I Choose to Keep Moving Forward’: Sanju Samson Reacts to Omission From IND Squad For AUS ODIs

Sanju Samson has scored 390 runs in 13 ODIs so far. (AFP Photo) Sanju Samson failed to make the cut in the India’s ODI squad for the three-match series against…

How To Get Instant PAN Through Your Aadhaar Number?

e-PANs are legally valid and widely accepted for all purposes that require a PAN. (Representative image) The Instant e-PAN service is available to all Individual taxpayers E-PAN Card Apply Online:…

Who Was Hardeep Singh Nijjar? Khalistan Terrorist at Centre of India-Canada Tussle | EXPLAINED

Last Updated: September 20, 2023, 16:50 IST Hardeep Singh Nijjar was from Bharsinghpur village in Punjab’s and moved to Canada in 1997. (Credits: IANS) Hardeep Singh Nijjar, a member of…

ICC Charges Bangladesh All-rounder Nasir Hossain And Seven Others in Abu Dhabi T10 Match-fixing Probe

Bangladesh all-rounder Nasir Hossain (AFP Image) The ICC has charged eight people including players, officials and a couple of Indian team owners, Parag Sanghvi and Krishan Kumar Chaudhary on different…

Are You Paying Home Loan EMI? Must Know How Bank Calculates Interest Part

Home loan interest rates may be fixed or floating. (Representative image) The interest on home loans is usually calculated either on monthly reducing or yearly reducing or daily reducing balance…

Prosecutors Probe Records, Dating Back to 2017, to See if Tesla Extended Perks to Elon Musk

Curated By: Shankhyaneel Sarkar Last Updated: September 20, 2023, 17:18 IST Washington D.C., United States of America (USA) SEC and federal prosecutors investigate perks Musk received from Tesla, Autopilot tech…

Sachin Tendulkar Performs Aarti, Wishes Fans on Ganesh Chaturthi: WATCH

Sachin Tendulkar performed aarti on Ganesh Chaturthi (Instagram/@sachintendulkar) Sachin Tendulkar performed aarti with the family on the festive occasion on Ganesh Chaturthi and posted a video on his social media…

Cyber Criminals Cash In: Study Finds 75% Scams Are Linked To Financial Frauds

These figures underscore the need for robust cyber security measures to safeguard financial transactions conducted online, the FCRF said. (Representative image) Social media-related crimes accounted for 12.02 per cent online…

UN: Taliban Committed Over 1600 Cases of Human Rights Violations in Last 19 Months

Last Updated: September 20, 2023, 14:44 IST An Afghan woman walks past a beauty salon in Kabul, Afghanistan, July 6, 2023. (Reuters/Ali Khara) UN report reveals extensive human rights violations,…